Readwise: Lessons in Trying to Beat Carrying Capacity in Consumer SaaS

Carrying capacity is effectively a ceiling on your SaaS business. How do you calculate it? Better yet, how do you beat it? Let's learn from Readwise and brainstorm what they should build next.

👋 Happy Sunday, friends!

I’m currently in Chicago for a wedding (and a Morgan Wallen concert at Wrigley Field). Hope you’re having a wonderful weekend wherever you are in the world.

Excited to share this first deep dive with you. We unpack carrying capacity - what it is, how it works - and then discuss how you beat it. Finally, I play CPO and talk about three things I would build next at Readwise. (I’m particularly keen on the “Read-it-later for business.”)

One final note, I’m trying out a book club geared towards Product folks. We’re reading Modern Monopolies in July over on Fable. If you’re interested, you can join the discussion for free here. Would love to have you!

Cheers,

Jeremey

Thanks for reading another edition of Strategy Meets World – bi-weekly deep dive into product strategy. If you’re new, check out the intro post and subscribe to get future issues in your inbox.

📬 Either way, email me at jeremeylduvall@gmail.com and tell me what you’re building. I’d love to hear it.

Imagine for a moment that you’re the CEO of a simple productivity app. You have a SaaS business model so customers pay monthly or yearly to use your product. Cash is coming in, profit margins look great, life is good!

Now, imagine that you could predict the total possible size of your business. That could either be a sobering or exciting number.

Allow me to introduce carrying capacity - a term I first learned about from Daniel Doyon, co-founder of Readwise.

Today, we’re going to dive into carrying capacity further. We’ll see how it’s possible to actually predict the total possible size of your business. Then, we’ll discuss the levers at your disposal for increasing revenue beyond your carrying capacity. All based in real-world examples.

Let’s dive in.

Defining Carrying Capacity

For simple SaaS businesses (one product, limited pricing options, etc), revenue is pretty straightforward to predict. Your revenue ultimately depends on three factors:

How many leads are coming in the door? (Acquisition)

What percentage of those leads are converting to paid? (Conversion)

How many existing subscribers are cancelling? (Churn)

Eventually, you can layer on pricing strategies, going multi-product, etc. We’ll get to that in a minute. For now, let’s pencil in some numbers and do some light math.

Paying customers starting Jan 2023: 10,000

Website traffic per month: 20,000

Conversion rate: 3.5%

Monthly churn rate: 4%

Pricing: $10 per month

We can predict how many subscribers you’ll have at the end of the month (and thus what your revenue will be).

(10,000 customers + 700 new customers - 428 churned customers) * $100

You grossed ~$103k! That’s pretty incredible. Now, here’s the sobering part. Your maximum monthly revenue is roughly $175k. How is this possible? To quote Daniel:

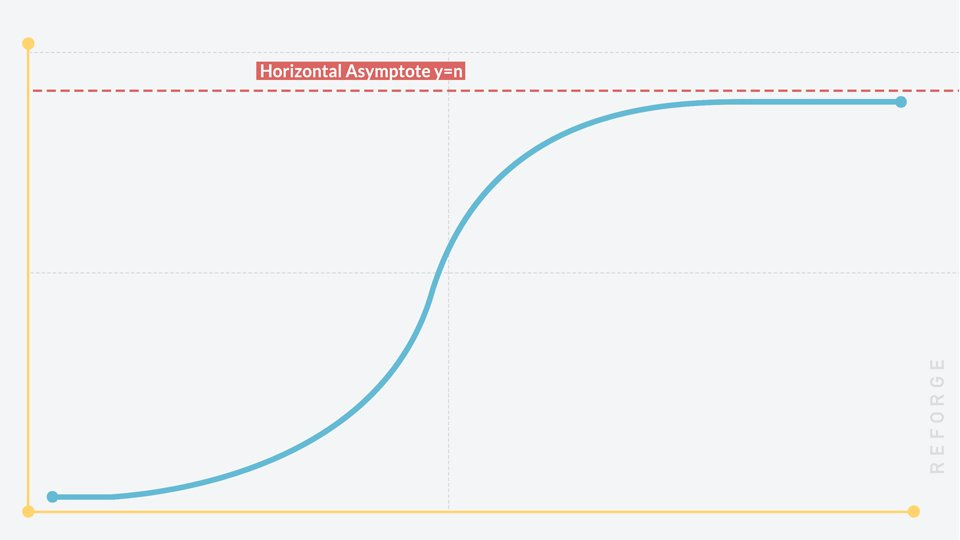

Eventually, the number of existing customers cancelling each month will equal the number of new customers subscribing.

That’s carrying capacity! In our case, we’ll plateau around 17,500 customers. At that point, we’ll be gaining the same 700 customers, but we’ll churn 700 as well.

Carrying capacity is effectively a ceiling on your business.

How Do You Break the Ceiling?

Now, we have this calculated limit on our business - $175k MRR. This is a pretty big number, but let’s pretend we’re not satisfied. What can we do to continue growing?

Our levers are straightforward. We discussed them earlier - increase top of funnel, boost conversion, or decrease churn. We can painstakingly optimize those over time, but a limit will still exist.

There’s another option though. Until now, we’ve assumed our average revenue per customer (ARPU) is fixed at $100. How could we increase that number?

Increase the price

Perhaps you priced too low in the beginning and can increase by a few dollars. There’s a tricky balance. If you go too high, you’ll start to increase churn. Ideally, the additional revenue from new and retained subscribers nets you out ahead even if churn ticks up a bit. Todoist did this in 2022. (I’m still a happy, paying customer.) It’s a viable option for some!

Pivot to Enterprise

The “land and expand approach.” Notion is a good example here. They originally launched with plans focused on individuals, but they’ve since pivoted almost exclusively to focus primarily on teams and Enterprise. This significantly changes the dynamics! ARPU can grow considerably on a per-seat model. You’re effectively playing a different game.

Go Multi-Product

Going multi-product can tap into each of our levers mentioned above:

New products attract new customers (increase top of funnel)

We can convert more customers because our product now solves more customer jobs (conversion)

We hopefully address some of the churn reasons (lower churn)

In addition, we’re probably going to charge more now that we have a new product to package. Thus, we’re driving up ARPU.

Readwise Goes Multi-Product

Late in 2022, Readwise introduced their second product, Reader.

Their initial product, Readwise, was offered a simple SaaS pricing model similar to what we used for our napkin math above. I’m a happy paying subscriber, but at $4.49 per month, there’s a natural ceiling to how big the business could get.

By launching Reader, they also introduced a new pricing plan - $4.49 per month for the original product or $7.99 for the original product plus the new Reader.

I instantly upgraded. They started earning $3.50 more per month off me as a customer. Spread across their entire subscriber base, this is a significant boon to the business (not to mention the new subscribers they gained because Reader is fantastic)!

Now, going multi-product is not a panacea for growth. There are real challenges! Pricing can be tricky. Funnel conversion from one product to the other isn’t a guarantee. The products might target a different end user. Your EPD team is now spread over two products - who owns coordination? Who makes sure everything fits seamlessly together? The list goes on (here’s a good thread recapping the challenges with going multi-product if you want more).

In this case, Readwise nailed it:

They maintained the old pricing structure so no one was forced to upgrade. They didn’t inadvertently bump churn.

There’s a natural overlap between their existing product (Readwise) and their new product (Reader). It serves the same core audience but in different ways. They also work harmoniously together - Readwise can pull in highlights from Reader.

Their initial product, Readwise, has limited (no?) competition. While they’re focused on building Reader, they’re not losing ground to a competitor on Readwise. The’s less risk to “distraction.”

What Should Readwise Build Next?

Going multi-product with Reader was a big next step for Readwise for many reasons, but as we discussed above, a primary one being it expanded their revenue opportunity and pushed past carrying capacity. Even with Reader though, there’s still a natural ceiling (albeit a higher one). What should Readwise build next?

Three ideas:

1. Social Reading

I believe that the future of social is going to be more niche than it is currently. Networks will be tailored to specific communities and their needs. Think Strava (community geared towards runners) versus Facebook. Or, within the more general networks like Facebook, most people are going to seek out their niche (e.g. Facebook Groups).

No one has quite cracked the social reading experience. Fable is one company working on this, but Readwise could be another. This wouldn’t be a new product line but a growth lever for their existing ones.

What could this look like?

Imagine a public feed of your favorite articles, highlights, and recent reads that you could embed anywhere with a few taps (and others could follow). Many writers I read are already embedding their articles at the bottom of newsletters and Substack posts (I do!). Imagine if you could visit a URL like readwise.io/feed/jeremey and check out my recent history + highlights.

Or, imagine a niche group for articles and podcasts. We could read, listen, and highlight them together. Reading suddenly becomes a social experience!

2. Curation and Recommendation

You have thousands of readers favoriting articles, tagging them, and highlighting passages. One obvious idea is to then turn and surface that to other readers in the app so Reader becomes an place for content discovery, not just consumption.

This is hardly a new idea. Pocket, a Reader competitor, already does this (probably others too). The difference is with Pocket, I feel like I’m reading the front page of the New York Times - everyone is reading the same articles.

Here’s a twist though - instead of doing this one article at a time, Readwise could pull together a group of articles around a topic and use AI to build a “course” of sorts. You could then discovery one-off articles that you wouldn’t have found otherwise, or Readwise could compile a 3-5 part series on churn, for example.

We’re all awash in a sea of content. If Readwise could crack the nut of recommendation and curation (while still surfacing unique content so we’re not all reading the same things), it could be really powerful.

3. Read Later But for Enterprise

I’ve worked at two larger, remote-first companies prior to joining Ness. In both cases, they built a homegrown “read later” tool to help employees consolidate all of the written content. Internal blog posts, company announcements, status updates - there were a lot of words to consume!

For new employees, this can be overwhelming. For veterans, it’s tough to keep up (or to know what’s critical vs. nice-to-have). Reader could solve both.

Imagine all of your Notion announcements, technical docs, Slack threads, etc. All in one place. Benefiting from the cool tools Reader has built for the general web.

I’m particularly bullish on this idea because it gives Readwise an entirely new revenue stream.

What I’m Reading

🪜The ladders of wealth creation. “In college I first heard Jason Fried from Basecamp talk about how making money is a skill—like playing the drums or piano—that you can get better at over time. That resonated with me immediately. I wouldn’t expect to be able to sit down at a piano for the first time and immediately play a concerto.” (Nathan Barry)

💰 Evaluating product investments. “One of the main reasons that all of this matters is because the role of a product organization is to solve customer problems and generate business return. Being really good at solving problems that don’t generate returns will bankrupt you.” (Adam Fishman)

🏷 Pricing your SaaS product. “Pricing is one of those topics that sits at the nexus of uncomfortable and long-term, which means companies often don’t think about it for far too long. Even when they eventually figure it out, they don’t touch it again for years. The most successful companies optimize monetization in some manner every quarter.” (Patrick Campbell)

📚Wool (Silo Series). “You’re saying that someone wiped out our history to stop us from repeating it?”

If you found something valuable in this edition, it would mean the world to me if you forwarded it to a friend or shared it on one of your social networks.

Better yet, reach out and tell me what you enjoyed. I’m always here at jeremeylduvall@gmail.com.

See you in a few weeks,

Absolutely loved this Jeremey! I'm doing a case study on Readwise for an internship application right now and ended up having to add a "What I wish Readwise would do" section and we had many of the same thoughts!

Say we took 2 angles.

1) On the basis of hindsight -- what we know now.

2) Without any hindsight.